tax attorneys

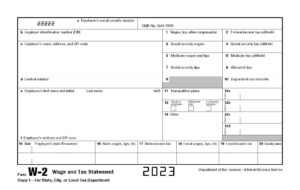

Let Us Fix Your IRS Payroll Tax Problems Every year, employers have until Jan. 31 to submit the Form W-2 Wage Statements and Form 1099 for Independent Contractors with the government. Use the instructions for Form W-2 to guide you through the filing process. Tax Law Offices specialized in resolving IRS Payroll…

Read MoreWhy Tax Law Offices is Based in Naperville IL (2024) Over the last 20 years, our tax defense and resolution services have called several Chicagoland areas home. Some may remember when we started on Dearborn Street in downtown Chicago. Others may have become part of the Tax Law Offices circle during our years in Schaumburg.…

Read MoreInstant IRS Penalty Reduction-Must Know! The IRS assesses taxpayers over $40 million in penalties each year. The most common penalties are for late payment, filing, or tax return errors, but there are many more. Having penalties piled on top of debt the taxpayer already owes can cause the amount due to quickly spiral…

Read MoreIs TAX LAW OFFICES the Right Firm for You? Tax Law Offices has handled some of the most threatening tax audit, collection and investigation cases. We see more emergency tax cases because Tax Law Offices is more specialized: Our typical case involves liability greater than $50,000 in tax and penalties. We focus on…

Read MoreWHAT IS THE EQUIFAX TAX LIEN SETTLEMENT? WHAT IS THE EQUIFAX TAX LIEN SETTLEMENT ($1500) Many people are surprised to learn they have tax liens. Unfortunately, those liens are public information, and are even reported by credit bureaus. This story relates to problems that our clients see every day. That is – incorrect or outdated…

Read MoreDealing with an IRS Revenue Officer can be overwhelmingly intimidating — especially if one stops by your home or business for the first time unannounced. You may feel like your heart is racing. You’re confused. Frankly, it doesn’t make sense as to why the officer is at your door. As far as you’re concerned, you…

Read MoreHow the IRS treats criminal tax investigations may seem like a secret. In fact, how they go about their process is public knowledge, which you can find on their website under How Criminal Investigations Are Initiated. For your benefit, we wanted to go through the IRS information and give you some insight on how it…

Read MoreYou’ve received a letter in the mail, and it’s got your name on it — along with some specific claims about tax liabilities. What do you do? Some people fold up the letter, tear it in half, and throw it in the trash. Others check to see who it’s from, discovering that the Internal Revenue…

Read MoreYou’re getting letters in the mail. The IRS won’t leave you alone. You discover you owe more taxes than you expected. Now you’re on the hook for hundreds, thousands, and, in some cases, hundreds-of-thousands of dollars. What can you do? You can continue to attempt to avoid the IRS, but that won’t work. We’ve seen…

Read MoreDid you get a letter in the mail from the IRS? Has the IRS informed you that you owe more than you already paid? It can feel frustrating and nerve wracking to owe more than expected—especially when you’re already doing your best to save money and spend it on the important things. Unfortunately, you’re not…

Read More