IRS Notice CP2000 – Am I Being Audited?

Have you received an IRS Notice CP2000? What does it mean? Keep reading to find out what you need to know.

need to know.

One of our attorneys was on a call with a client who received an IRS Notice CP2000. Before hiring Tax Law Offices, she called her tax return preparer. We won’t say the name, but it’s one of those big national companies that are always advertising on TV.

That company has an “audit protection guarantee” stating that if you are audited, they will represent you. Instead of representing her, they told her that IRS often sends these letters out, they don’t mean anything, and everyone gets them.

This information is WRONG. Not only did they not represent her, but they also did not have the knowledge or training to recognize what the letter meant.

That letter meant she was under audit by the IRS!

What To Do If You Receive an IRS Notice CP2000

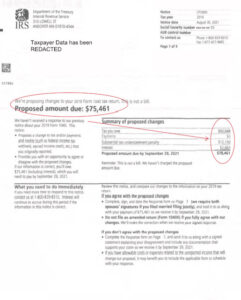

IRS Notice CP2000 means that you are under audit by the IRS.

IRS Notice CP2000 means that you are under audit by the IRS.

That means that IRS is likely looking for underreported income. Keep in mind the penalty for underreported income can be 20% of the tax amount that was underreported.

If a response is not made, the IRS will assess the proposed tax amount and any penalties.

You will notice on the letter that it says “proposed changes.” That means the tax hasn’t been assessed yet, and you can still fight those proposed changes. How do you do that?

You need to hire an experienced tax attorney. Unfortunately, your accountant or tax return preparer simply does not have the knowledge to respond to an IRS audit effectively.

You also need to act quickly. There is a response date on the notice, and it is in your best interest to respond before the deadline.

Being audited can expose you to legal and financial risk. An experienced attorney can protect you.

If you are being audited, contact Tax Law Offices today. We know how to win IRS audits!