income tax lawyer

Steps in Handling Payroll Tax So, your maybe business owes IRS payroll tax. You may be receiving notices that say the IRS is going to collect. The letters threaten to levy (or seize) of your assets and bank funds. You have to fix this problem. Failure to correct the problem could end your…

Read MoreDon’t Talk to Strangers! (New IRS Scam) The IRS just published this new story about a new scam happening. Be careful of strangers offering help. Now, people call you, pretending to work for the IRS. They offer the “service” of helping you set up your IRS online account. They tell you that it will…

Read MoreFree Help for Tax Problems – Form 911 This is an IRS Form 911. It is used to contact the IRS Taxpayer Advocate’s Office. To use the Taxpayer Advocate service, just complete Form 911 and submit. Let me tell you a few things about that service, and how it is commonly used.…

Read MoreHow to Handle Due Diligence Audits Tax return preparers, if you are facing an IRS due diligence audit, let me give you some guidance. You may have even heard stories, advice, or other information from YouTube, from other tax return preparers, or even tax resolution professionals. A lot of this information won’t help you…

Read MoreDeduct Gambling Losses on Your State Taxes This Article is for Gamblers Gamblers, whether professional, habitual, or just casual players, have a few things in common. First, they occasionally win. But also, they occasionally finish the year with a net loss from wagers. Still, they all must prepare federal and state tax returns showing…

Read MoreIRS LETTER LT38 In 2020, due to COVID-19, the IRS began to suspend most of its collection enforcements and bank fund seizures. This courtesy was a form of COVID relief. Also, some automatic penalty relief was granted for 2019 and 2020 tax returns. Thank you, IRS. But that suspension has ended. Now, the…

Read MoreHow to Choose Tax Professionals (Not Doughnuts) Because it’s the beginning of the year, I want to discuss how to choose the right tax professionals to help you. We see advertisements constantly with companies that promise to get you the largest refund possible. Well, please be careful about that. This is why for the…

Read MoreHow to Help Your Boss with Tax Issues (3 Ways) This article is to help employees of companies with owners who are overwhelmed. This especially applies if you work for a struggling business that is having trouble keeping enough cash flow. Some of the signs of a struggling company may be: Payroll is often slow,…

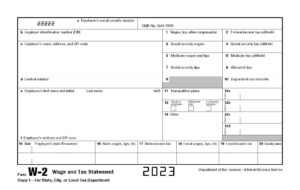

Read MoreLet Us Fix Your IRS Payroll Tax Problems Every year, employers have until Jan. 31 to submit the Form W-2 Wage Statements and Form 1099 for Independent Contractors with the government. Use the instructions for Form W-2 to guide you through the filing process. Tax Law Offices specialized in resolving IRS Payroll…

Read MoreHow to Cure the Top 3 Problems of Business Owners The 3 most common concerns that I hear from business owners are not what you might expect. Self-employed people want to “get their finances in order”. And that can mean a few different things. This could mean more savings, better cash flow, or improving their…

Read More