business tax lawyer il

Payroll Tax First Step (Not a Cliff Dive) Your business might owe tens of thousands or even hundreds of thousands in payroll tax to the IRS. You might even feel like you’ve fallen off a cliff or drowning underwater. But remember, even when it seems there is no way to end the problem, there…

Read MoreSteps in Handling Payroll Tax So, your maybe business owes IRS payroll tax. You may be receiving notices that say the IRS is going to collect. The letters threaten to levy (or seize) of your assets and bank funds. You have to fix this problem. Failure to correct the problem could end your…

Read MoreDon’t Talk to Strangers! (New IRS Scam) The IRS just published this new story about a new scam happening. Be careful of strangers offering help. Now, people call you, pretending to work for the IRS. They offer the “service” of helping you set up your IRS online account. They tell you that it will…

Read MoreERC Voluntary Disclosure Program (IRS) Deadline March 22, 2024 to Get Out Are you familiar with the March 22nd deadline for the Employee Retention Credit Voluntary Disclosure Program? Basically, if you received an Employee Retention Credit refund, and if you really were not entitled to it, the Voluntary Disclosure Program allows you to turn…

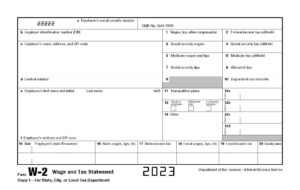

Read MoreFind W-2 Forms for Bigger State Refunds Take a look at this IRS form W2. Most of us know that this form is important when preparing and filing your tax return. Every year the information from this form is included within your tax return. But also, attach this form to your federal and…

Read MoreHow to Choose Tax Professionals (Not Doughnuts) Because it’s the beginning of the year, I want to discuss how to choose the right tax professionals to help you. We see advertisements constantly with companies that promise to get you the largest refund possible. Well, please be careful about that. This is why for the…

Read MoreIRS Text Message Scam – Watch Out! The image shown is a text message sent to millions of American cell phones. It begins with the words “IRS Government”. The message goes on to state that: “The system detects an error in the calculation of your tax please complete the data for a tax…

Read MoreHow to Help Your Boss with Tax Issues (3 Ways) This article is to help employees of companies with owners who are overwhelmed. This especially applies if you work for a struggling business that is having trouble keeping enough cash flow. Some of the signs of a struggling company may be: Payroll is often slow,…

Read MoreLet Us Fix Your IRS Payroll Tax Problems Every year, employers have until Jan. 31 to submit the Form W-2 Wage Statements and Form 1099 for Independent Contractors with the government. Use the instructions for Form W-2 to guide you through the filing process. Tax Law Offices specialized in resolving IRS Payroll…

Read MoreHow to Cure the Top 3 Problems of Business Owners The 3 most common concerns that I hear from business owners are not what you might expect. Self-employed people want to “get their finances in order”. And that can mean a few different things. This could mean more savings, better cash flow, or improving their…

Read More