tax resolution

Steps in Handling Payroll Tax So, your maybe business owes IRS payroll tax. You may be receiving notices that say the IRS is going to collect. The letters threaten to levy (or seize) of your assets and bank funds. You have to fix this problem. Failure to correct the problem could end your…

Read MoreDeduct Gambling Losses on Your State Taxes This Article is for Gamblers Gamblers, whether professional, habitual, or just casual players, have a few things in common. First, they occasionally win. But also, they occasionally finish the year with a net loss from wagers. Still, they all must prepare federal and state tax returns showing…

Read MoreIRS LETTER LT38 In 2020, due to COVID-19, the IRS began to suspend most of its collection enforcements and bank fund seizures. This courtesy was a form of COVID relief. Also, some automatic penalty relief was granted for 2019 and 2020 tax returns. Thank you, IRS. But that suspension has ended. Now, the…

Read MoreHow to Choose Tax Professionals (Not Doughnuts) Because it’s the beginning of the year, I want to discuss how to choose the right tax professionals to help you. We see advertisements constantly with companies that promise to get you the largest refund possible. Well, please be careful about that. This is why for the…

Read MoreIRS Text Message Scam – Watch Out! The image shown is a text message sent to millions of American cell phones. It begins with the words “IRS Government”. The message goes on to state that: “The system detects an error in the calculation of your tax please complete the data for a tax…

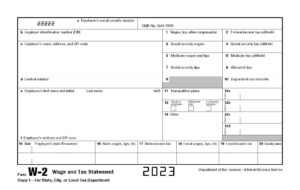

Read MoreLet Us Fix Your IRS Payroll Tax Problems Every year, employers have until Jan. 31 to submit the Form W-2 Wage Statements and Form 1099 for Independent Contractors with the government. Use the instructions for Form W-2 to guide you through the filing process. Tax Law Offices specialized in resolving IRS Payroll…

Read MoreHow to Cure the Top 3 Problems of Business Owners The 3 most common concerns that I hear from business owners are not what you might expect. Self-employed people want to “get their finances in order”. And that can mean a few different things. This could mean more savings, better cash flow, or improving their…

Read MoreIRS’s Top 3 Targets for Small Biz Owners (2024) Let’s talk about the Top 3 Targets the IRS is very concerned about coming into next year. Spoiler alert: each is related to payroll. #1 – Worker Classification (Form 1099 or W-2) You may have workers for whom you report earnings on Form…

Read MoreTAX LAW OFFICES, INC. MAINTAINS THE BETTER BUSINESS BUREAU HIGHEST A+ ACCREDITATION Naperville, IL – December 4, 2023 – Tax Law Offices and StopIRSproblem.com is pleased to announce today that it has again met 100% of the Better Business Bureau’s standards. The firm that is referred by CPAs to handle business tax problems continues as…

Read MoreHow to Answer the IRS Letter CP2000 With the Letter CP2000, the IRS wants to audit 100% of people who have not reported all income. Using its new tech tools, the government can now choose many more people to be audited. The CP2000 letter is the IRS’s official notice that you are under audit…

Read More