Tax Attorney

RESOLVE PAYROLL BACK TAXES WHERE DO YOU BEGIN? This blog has three tips on how to begin your payroll tax resolution. Payroll tax liability can be a huge problem for businesses. Especially when payroll taxes accumulate for several months (or years) without being paid to the federal or state governments. It starts with…

Read MoreDeduct Gambling Losses on Your State Taxes This Article is for Gamblers Gamblers, whether professional, habitual, or just casual players, have a few things in common. First, they occasionally win. But also, they occasionally finish the year with a net loss from wagers. Still, they all must prepare federal and state tax returns showing…

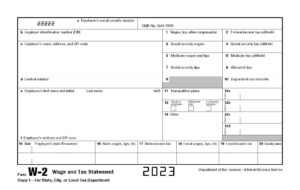

Read MoreFind W-2 Forms for Bigger State Refunds Take a look at this IRS form W2. Most of us know that this form is important when preparing and filing your tax return. Every year the information from this form is included within your tax return. But also, attach this form to your federal and…

Read MoreIRS Text Message Scam – Watch Out! The image shown is a text message sent to millions of American cell phones. It begins with the words “IRS Government”. The message goes on to state that: “The system detects an error in the calculation of your tax please complete the data for a tax…

Read MoreLet Us Fix Your IRS Payroll Tax Problems Every year, employers have until Jan. 31 to submit the Form W-2 Wage Statements and Form 1099 for Independent Contractors with the government. Use the instructions for Form W-2 to guide you through the filing process. Tax Law Offices specialized in resolving IRS Payroll…

Read More Do Tax Liens Affect Your Credit Rating? This is a trick question. The Positives: Tax liens currently do not affect your credit score. Because of the Equifax case back in 2018, the credit bureaus stopped including tax liens on credit reports as derogatory history. Note: Before 2018, yes, tax liens definitely were…

Read MoreWhy Tax Law Offices is Based in Naperville IL (2024) Over the last 20 years, our tax defense and resolution services have called several Chicagoland areas home. Some may remember when we started on Dearborn Street in downtown Chicago. Others may have become part of the Tax Law Offices circle during our years in Schaumburg.…

Read MoreIRS’s Top 3 Targets for Small Biz Owners (2024) Let’s talk about the Top 3 Targets the IRS is very concerned about coming into next year. Spoiler alert: each is related to payroll. #1 – Worker Classification (Form 1099 or W-2) You may have workers for whom you report earnings on Form…

Read MoreTAX LAW OFFICES, INC. MAINTAINS THE BETTER BUSINESS BUREAU HIGHEST A+ ACCREDITATION Naperville, IL – December 4, 2023 – Tax Law Offices and StopIRSproblem.com is pleased to announce today that it has again met 100% of the Better Business Bureau’s standards. The firm that is referred by CPAs to handle business tax problems continues as…

Read MoreCan You Believe This? The Newest on Fake Charities! This post is to help anyone. I want to especially advise our seniors, and friends who may be challenged with speaking English. These matters. There are charity causes created by disease, weather, disaster, and even war that are actively seeking help from the public. And…

Read More