audited by irs

RESOLVE PAYROLL BACK TAXES WHERE DO YOU BEGIN? This blog has three tips on how to begin your payroll tax resolution. Payroll tax liability can be a huge problem for businesses. Especially when payroll taxes accumulate for several months (or years) without being paid to the federal or state governments. It starts with…

Read MoreHow to Choose Tax Professionals (Not Doughnuts) Because it’s the beginning of the year, I want to discuss how to choose the right tax professionals to help you. We see advertisements constantly with companies that promise to get you the largest refund possible. Well, please be careful about that. This is why for the…

Read MoreHow to Help Your Boss with Tax Issues (3 Ways) This article is to help employees of companies with owners who are overwhelmed. This especially applies if you work for a struggling business that is having trouble keeping enough cash flow. Some of the signs of a struggling company may be: Payroll is often slow,…

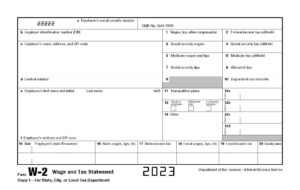

Read MoreLet Us Fix Your IRS Payroll Tax Problems Every year, employers have until Jan. 31 to submit the Form W-2 Wage Statements and Form 1099 for Independent Contractors with the government. Use the instructions for Form W-2 to guide you through the filing process. Tax Law Offices specialized in resolving IRS Payroll…

Read MoreHow to Cure the Top 3 Problems of Business Owners The 3 most common concerns that I hear from business owners are not what you might expect. Self-employed people want to “get their finances in order”. And that can mean a few different things. This could mean more savings, better cash flow, or improving their…

Read More Do Tax Liens Affect Your Credit Rating? This is a trick question. The Positives: Tax liens currently do not affect your credit score. Because of the Equifax case back in 2018, the credit bureaus stopped including tax liens on credit reports as derogatory history. Note: Before 2018, yes, tax liens definitely were…

Read MoreTax Law Offices is Ready for New Year‘s Changes at IRS (2024) Orlando: We constantly improve our tax lawyers and technical support staff. This time the training conference was in Orlando FL, which is one of the most fun places in this country! Lots to do, lots to see. And there was a lot…

Read MoreWhy Tax Law Offices is Based in Naperville IL (2024) Over the last 20 years, our tax defense and resolution services have called several Chicagoland areas home. Some may remember when we started on Dearborn Street in downtown Chicago. Others may have become part of the Tax Law Offices circle during our years in Schaumburg.…

Read MoreIRS’s Top 3 Targets for Small Biz Owners (2024) Let’s talk about the Top 3 Targets the IRS is very concerned about coming into next year. Spoiler alert: each is related to payroll. #1 – Worker Classification (Form 1099 or W-2) You may have workers for whom you report earnings on Form…

Read MoreHow to Answer the IRS Letter CP2000 With the Letter CP2000, the IRS wants to audit 100% of people who have not reported all income. Using its new tech tools, the government can now choose many more people to be audited. The CP2000 letter is the IRS’s official notice that you are under audit…

Read More