How to Handle Due Diligence Audits

How to Handle Due Diligence Audits Tax return preparers, if you are facing an IRS due diligence audit, let me give you some guidance. You may have even heard stories, advice, or other information from YouTube, from other tax return preparers, or even tax resolution professionals. A lot of this information won’t help you…

Deduct Gambling Losses on Your State Taxes

Deduct Gambling Losses on Your State Taxes This Article is for Gamblers Gamblers, whether professional, habitual, or just casual players, have a few things in common. First, they occasionally win. But also, they occasionally finish the year with a net loss from wagers. Still, they all must prepare federal and state tax returns showing…

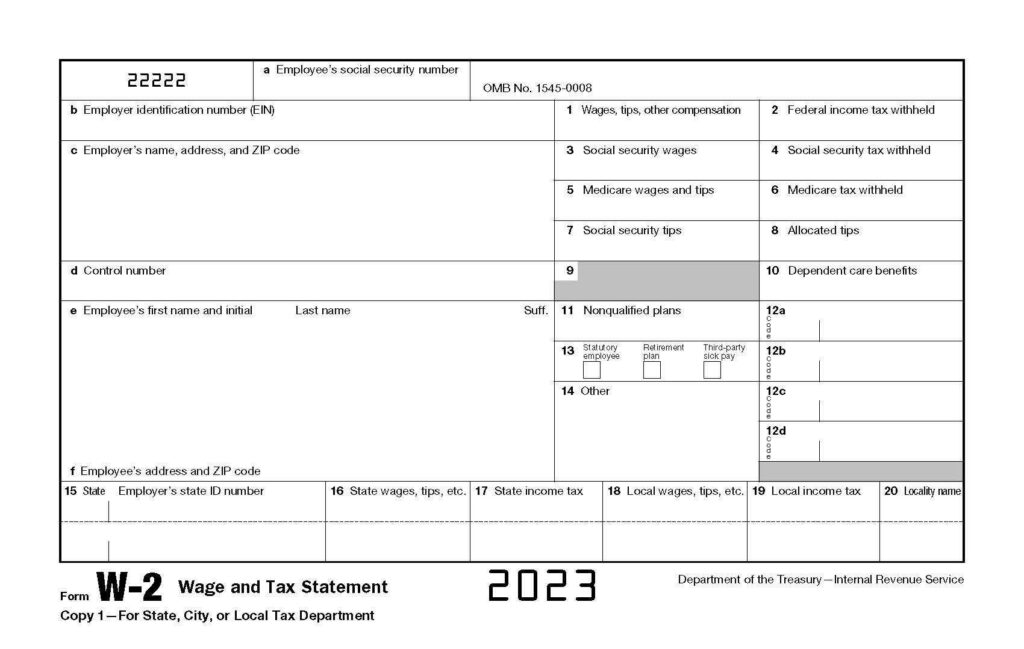

Find W-2 Forms for Bigger State Refunds

Find W-2 Forms for Bigger State Refunds Take a look at this IRS form W2. Most of us know that this form is important when preparing and filing your tax return. Every year the information from this form is included within your tax return. But also, attach this form to your federal and…

IRS Text Message Scam – Watch Out!

IRS Text Message Scam – Watch Out! The image shown is a text message sent to millions of American cell phones. It begins with the words “IRS Government”. The message goes on to state that: “The system detects an error in the calculation of your tax please complete the data for a tax…

January 31 Form W-2 and Form 1099 Filing Deadline – Now What?

Let Us Fix Your IRS Payroll Tax Problems Every year, employers have until Jan. 31 to submit the Form W-2 Wage Statements and Form 1099 for Independent Contractors with the government. Use the instructions for Form W-2 to guide you through the filing process. Tax Law Offices specialized in resolving IRS Payroll…

How to Answer the IRS Letter CP2000

How to Answer the IRS Letter CP2000 With the Letter CP2000, the IRS wants to audit 100% of people who have not reported all income. Using its new tech tools, the government can now choose many more people to be audited. The CP2000 letter is the IRS’s official notice that you are under audit…

Happy Holidays!!

Happy Holidays!! With so much focus on our Tax Matters practice, sometimes we forget just to stop to say THANK YOU! You have been a part of our year, no matter whether you’re a client, business owner, fellow accountant, or fellow lawyer. Our Tax Law Offices have enjoyed helping solve IRS tax problems for you and…

Experienced Attorney ONLY

Experienced Attorney ONLY HELP WANTED! Results matter. When you have a tax problem, you expect results. You don’t want empty promises, or big lawyer-sounding words. And you don’t want to waste your money! Right? Hiring an experienced attorney is the secret to getting the BEST results with your IRS tax collection problem. You want a lawyer with…

3 Things to Know If You Get Paid Cash Under the Table

3 Things to Know If You Get Paid Cash Under the Table Getting paid under the table may seem like a win-win situation. You don’t have to keep track of your income, and even better, you don’t have to report your income to the IRS. If you don’t report your income, then you don’t…

IRS Audits – Everything You Need to Know

IRS Audits – Everything You Need to Know The filing deadline has passed, and tax returns have been filed. Many Americans have gone from worrying about getting their returns filed to worrying about hearing those dreaded words “IRS Audit.” Even the thought of being audited strikes fear in most people’s hearts. So today, we…