ERC Voluntary Disclosure Program (IRS) – Deadline March 22, 2024 to Bail Out

ERC Voluntary Disclosure Program (IRS) Deadline March 22, 2024 to Get Out Are you familiar with the March 22nd deadline for the Employee Retention Credit Voluntary Disclosure Program? Basically, if you received an Employee Retention Credit refund, and if you really were not entitled to it, the Voluntary Disclosure Program allows you to turn…

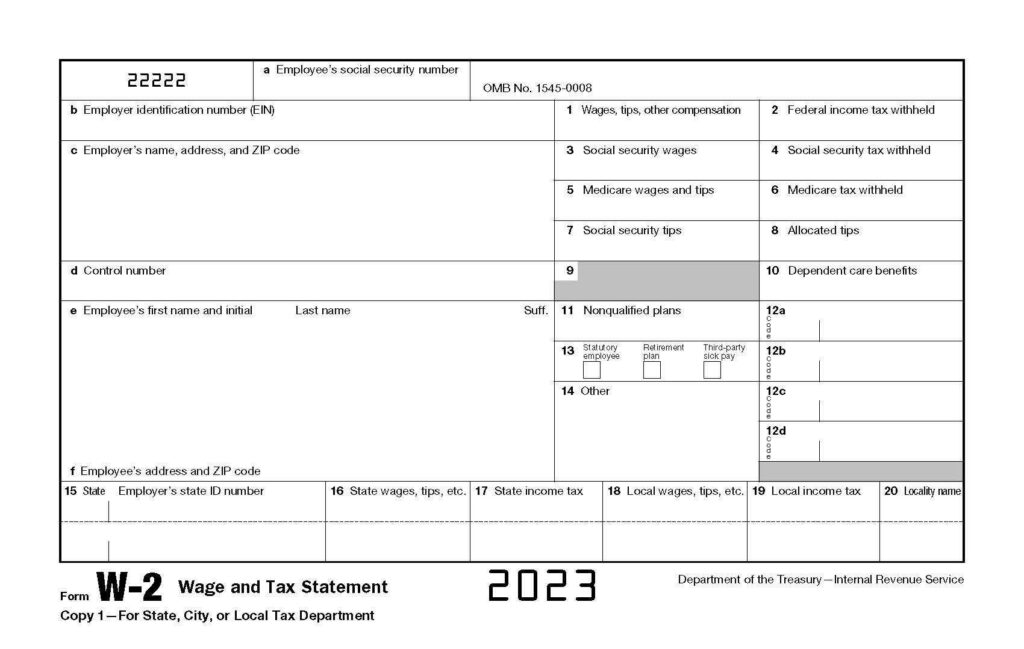

January 31 Form W-2 and Form 1099 Filing Deadline – Now What?

Let Us Fix Your IRS Payroll Tax Problems Every year, employers have until Jan. 31 to submit the Form W-2 Wage Statements and Form 1099 for Independent Contractors with the government. Use the instructions for Form W-2 to guide you through the filing process. Tax Law Offices specialized in resolving IRS Payroll…

Top 3 Problems of Business Owners (and How to Cure Them)

How to Cure the Top 3 Problems of Business Owners The 3 most common concerns that I hear from business owners are not what you might expect. Self-employed people want to “get their finances in order”. And that can mean a few different things. This could mean more savings, better cash flow, or improving their…

How Do Tax Liens Affect Your Credit Rating?

Do Tax Liens Affect Your Credit Rating? This is a trick question. The Positives: Tax liens currently do not affect your credit score. Because of the Equifax case back in 2018, the credit bureaus stopped including tax liens on credit reports as derogatory history. Note: Before 2018, yes, tax liens definitely were…

Tax Law Offices is Ready for New Year‘s Changes at IRS (2024)

Tax Law Offices is Ready for New Year‘s Changes at IRS (2024) Orlando: We constantly improve our tax lawyers and technical support staff. This time the training conference was in Orlando FL, which is one of the most fun places in this country! Lots to do, lots to see. And there was a lot…

Why Tax Law Offices is Based in Naperville IL (2024)

Why Tax Law Offices is Based in Naperville IL (2024) Over the last 20 years, our tax defense and resolution services have called several Chicagoland areas home. Some may remember when we started on Dearborn Street in downtown Chicago. Others may have become part of the Tax Law Offices circle during our years in Schaumburg….

Frozen Refund? Options While Awaiting IRS Employee Retention Credit

Frozen Refund? Options While Awaiting IRS Employee Retention Credit Refund Updates: You may have an IRS Employee Retention Credit (ERC) refund application on file. In September 2023, we were advised by the IRS that the government stopped processing applications during the remainder of 2023. Part of the reason for this moratorium on ERC refund…

IRS Employee Retention Credit Freeze 2023

IRS Employee Retention Credit Freeze 2023 IRS has placed a “moratorium” (or freeze) on the Employee Retention Credit application processing for the remainder of 2023. This means that IRS has frozen handling all new Forms 5884-A submitted for the ERC. Until further notice, this ERC application freeze remains through December 31, 2023. Why…

Can You Repay Yourself Tax-Free from Business

Can You Repay Yourself Tax-Free from Business Question from Business Owners: If you made a loan to your new business, can you pay yourself back tax-free? In other words, are you going to be taxed when you pay back the cash that you invested into your small business. What About Me? Did…

2023 Best Tax Resolution: $800K Income to $200/ Week Payment

2023 Best Tax Resolution: $800K Income to $200/ Week Payment Tax Law Offices recently had a client who worked as a truck driver. He hadn’t filed tax returns or paid his taxes since 2015, and he was terrified he was going to be sent to prison. Once he hired us, we immediately went…